Who is Really Paying More of Their Income in Federal Income Taxes - the Middle Class, the Wealthy, or Someone Else?

publication date: Apr 12, 2012

Tax Day 2012 is Tuesday April 17th - that's the deadline for filing your personal income tax return and paying any outstanding tax bill. You can file for a six-month extension of time to complete the return but you will still need to pay your estimated tax bill by the April 17th deadline.

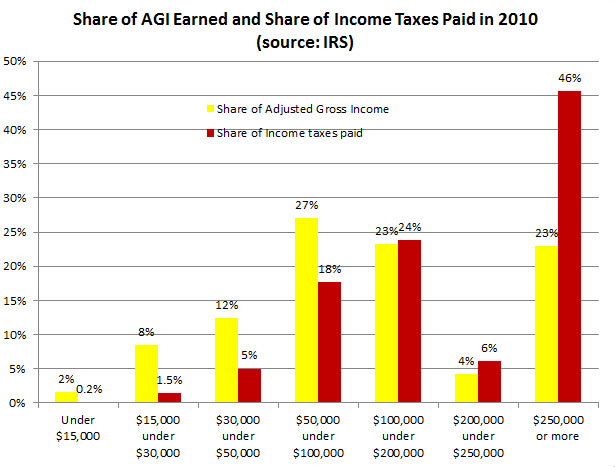

The non-partisan Tax Foundation has compiled some interesting data regarding what portion of adjusted gross income (AGI) was earned by folks in various income categories and how that compares with the portion of federal income taxes paid (see graph below). The chart clearly shows that lower income earners pay a much smaller portion of taxes on their income than do high income earners. Our so-called progressive system of taxation is indeed working but you'd never know that from some of the continuing political rhetoric that we hear such as the Buffett Rule.

For example, you can see in the chart below that folks with an AGI between $15,000 and $30,000 earn 12 percent of the total income yet pay only 5 percent of the total tax. Meanwhile, folks earning more than $250,000 earn about 23 percent of the total income yet pay 46 percent of the total income taxes.

Here are some additional tax factoids from the Tax Foundation:

- 143 million tax returns were filed with the IRS in 2010, some of which represent households and married couples.

- Americans paid federal incomes taxes of $945 billion.

- Only 85 million actually paid taxes out of the 143 million filers. In other words, 58 million, or 41%, were non-payers.

- 96% of non-payers made less than $50,000.

- The IRS paid out $105 billion in refundable credits to filers who paid no income tax.

- 26 million filers took the refundable earned income tax credit, and they received $56 billion from the IRS despite having paid no income taxes.

- 21 million filers took the refundable child credit, and they received $27 billion from the IRS despite having paid no income taxes.

- 4 million paid the Alternative Minimum Tax.

- The IRS estimates that it takes more than 7 billion hours to comply with the tax code each year.

- The tax code is now 3.8 million words long.

- Over the last ten years there have been about 4,428 changes to the tax code, or more than one a day, including about 579 changes in 2010 alone.