Update: Government Response to High Oil and Gasoline Prices

publication date: May 16, 2012

Update: There continues to be plenty of bickering in Washington over the supposed causes of high oil and gasoline prices and what actions the government has or has not taken. The following graphic from the American Petroleum Institute shows a big source of the problem. Just 13 percent of federally owned land has drilling allowed on it. U.S. oil production has increased slightly in recent years but that is only because production is up on privately owned, not government owned land, 87 percent of which offshore is off limits to drilling.

Opening up more federal land for exploration and production would increase supply, reduce prices and perhaps equally importantly, bring in much needed federal tax revenue.

Update March 30, 2012: In a bi-partisan vote that went against President Obama's wishes, the Democrat controlled Senate voted against ending $4 billion in oil industry "tax breaks" which are also allowed in other comparable industries. The fact that a number of Democrats sided with Republicans is a good sign that sometimes economic common sense wins out over partisan politics.

In April 2011, I wrote the article below in which I explained why ending oil industry tax breaks allowed other comparable industries would be severely misguided. Specifically, gasoline prices would likely rise further in response. Please see the article below for the causes of and solutions to high oil and gasoline prices.

Our federal government is filled with politicians whose training and credentials more often than not are in the legal realm. The typical path to serve in the U.S. Congress: get a law degree, practice law for a few years and then serve in state government before working one's way up to getting elected to the U.S. House or Senate.

About 36 percent of the U.S. House of Representatives and 54 percent of the U.S. Senate is currently comprised of lawyers.

Having a law background can be helpful and even beneficial and I have nothing against attorneys. That said, I do think that part of the reason that Washington is out of touch with the economy is because we have far too many lawyers and not enough politicians who understand how business really works.

And, this brings me to the current effort taking place to eliminate $4 billion in "tax breaks" going to oil companies. It seems that most politicians and commentators - on both ends of the political spectrum are jumping on board with this. These folks are unfortunately misguided and dare I say wrong.

Bashing Big Oil Companies

It's easy to beat up on big oil companies. They regularly announce what seem to be gargantuan/record profits. Nearly all of us have to fill up the gas tank in our car and it irks us whenever gasoline prices spike higher. Popular commentators like Bill O'Reilly routinely accuse the big oil companies of price gouging and price fixing. And then there's the trail of negative events from the Exxon Valdez oil spill to BP's Deepwater Horizon disaster in the Gulf of Mexico.

But, in reality, oil companies and the oil industry aren't fundamentally different than other industries. In fact, as I documented in my article, "The Real Cause of High Oil Prices" back in June, 2008, during that spike in oil and gasoline prices, dozens of other industries enjoy higher profit margins. The industry directly employs more than two million workers in the U.S. (and another seven million workers indirectly who are dependent upon the industry for their livelihood) and accounts for just under 8 percent of U.S. economic output.

The U.S. oil industry also pays a relatively high overall effective tax rate - about 41 percent - which is above the average overall rate of about 26.5 percent for all other industries.

The Impact of Taking Away $4 Billion in Oil Industry Tax Breaks

Yet, many politicians and pundits would have you believe that they are justified in wanting to take away $4 billion in tax breaks from the oil industry because oil companies make obscene and excessive profits. The industry doesn't actually receive any subsidies or price supports and the $4 billion in question at this point are relatively straight forward deductions for business exploration expenses. Other industries that manufacture something actually get a bigger write-off from their section 199 deductions - 9 percent versus 6 percent for the oil industry.

What's being proposed now is to eliminate the section 199 deduction completely just for the oil industry. Making this change would be dumb and counterproductive because it would lead to higher expenses and taxes for the domestic oil industry which would:

- Discourage smaller companies from oil exploration

- Discourage domestic oil production in favor of such production overseas which would add to the U.S.' employment problems.

- Increase retail gasoline prices for already strapped consumers paying around $4+ a gallon.

What Are You Paying in Gasoline Taxes?

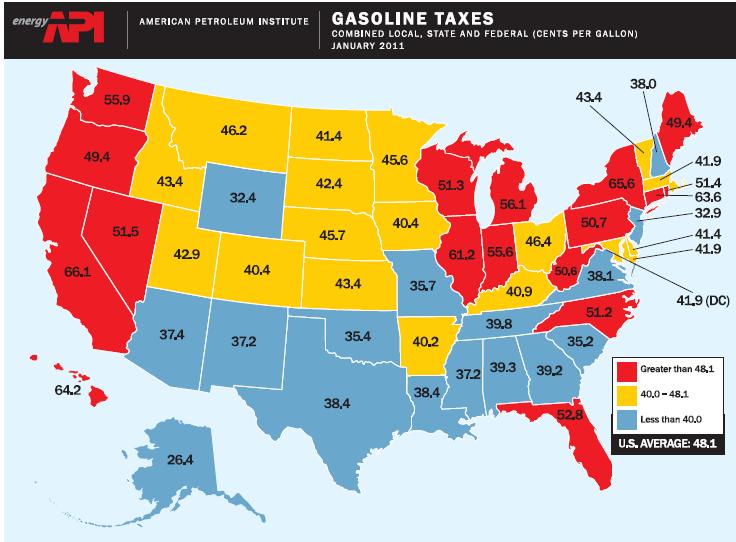

The last thing we need at this point is higher gasoline prices and higher taxes on the production of gasoline. Lost in all of this discussion over bashing the oil industry is the fact that consumers are already paying a lot in taxes themselves through gasoline taxes collected at the retail level (see map below). As of this past January, 2011, the average gasoline tax paid by retail consumers was a hefty 48 cents per gallon which accounted for about 16 percent of the prices of a gallon of gasoline.

Congress should be encouraging rather than discouraging domestic energy production. In addition to creating much needed domestic jobs, doing so will reduce America's dependence on undependable Middle East oil and reduce the amount of money being sent to governments and entities that undermine American security.

If oil and gasoline prices remain elevated, I expect American voters in the 2012 elections to punish politicians who didn't take sensible steps to address this problem.