Do You or Someone You Know Avoid Certain Money Decisions?

publication date: Oct 1, 2010

If you or someone you know is a money avoider, my goal isn't to turn you or them into someone who loves dealing with money. That's not going to happen. However, I can show you how work together to ensure that you can accomplish common financial goals and won't suffer the ill affects that money avoiders so often do in their neglect of their finances.

Coming to terms with money avoidance takes time and patience. That statement isn't meant to provide you with a reason to forgo making changes in your financial life. Instead, I'm relaying a fact, and reminding you that change takes time and some steps forward interrupted by steps back.

The first and most important part in the process is to recognize the tendency and some of the biggest causes. Many people find it helpful to write down their feelings relating to money avoidance or to speak about their feelings and history with money with someone who is an empathic listener.

"I always felt stupid about math and wholly inadequate. I can't even bring myself to use a calculator out of fear I won't even know how to use that properly," says Heidi a forty-something year-old woman. It took Heidi about two years to make some major changes in how she handled her personal finances. She began to make progress when I was able to persuade her that she didn't have to be a math whiz to make positive financial changes. Heidi didn't have major spending problems, but she was sloppy and lazy about saving money and investing it well.

I had her sign up for her employer's retirement savings plan so that she could begin to save about 8 percent of her salary. We had the money withdrawn from her salary and directed into a handful of well-diversified mutual funds. "I can't believe how painless it is to do this, and there was virtually no math involved. All I had to do was complete a one-page enrollment form, which required me to say what funds and what percentage of my contribution went into each fund that I selected," said Heidi.

With the meager amounts she had been saving that were languishing in a low-interest bank account, Heidi would've needed to work until her mid-seventies to achieve the standard of living in retirement that she desired. Now, she's on track to be able to stop working by her late fifties. Seeing these quantifiable changes in her retirement age and gaining a basic understanding of the steps she needs to take to reach her goals was a great motivating source to Heidi and has given her savings a purpose. Equally, if not more important, she feels in control of her life financially, and rid herself of that ever-constant anxiety about not being on top of things.

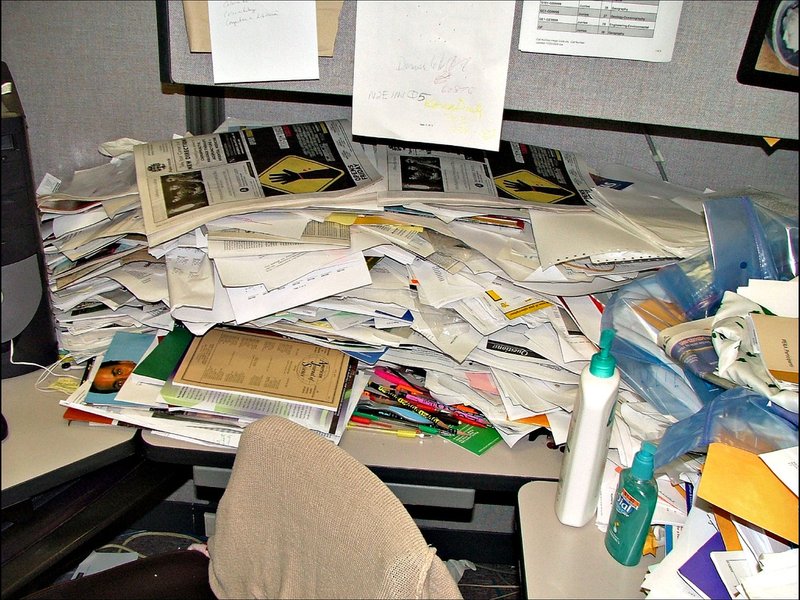

In my work as a financial counselor, I found that many avoiders typically felt greatly overwhelmed with a laundry list of financial to dos. That's why you should prioritize and only work on the top one or two items at a time. I'd tell clients that even though they might have a total of eight or ten things on their longer task lists, they shouldn't expect to complete those next week or even next month. It might take six months to a year to work through the longer list. Here's how to get control of your money:

- Pay your bills automatically. People who are financially disorganized often are late paying bills. Late payments, particularly when it comes to paying taxes, are a problem that can lead to substantial late fees, interest, and penalties. Even if the fees and additional interest from individual late payments - $5 here and $30 dollars there - don't seem all that significant on their own, they can add up to a hefty total if you make paying bills late a habit. One of the best things that a money avoider can do with their bills is to set each of them up for automatic payment. Whether it's your phone, utility, or monthly mortgage bill, you should be able to establish an automatic payment plan that doesn't require you to initiate payment. With just a little upfront work with each creditor or billing company - often not much more effort than paying a monthly bill - you can rid yourself of unnecessary fees and interest and save a little time each month. Many companies accept (and actually prefer) payment through an electronic transfer from your bank account. Some loan holders (such as the U.S. Department of Education) may even lessen your interest rate slightly in return for what amounts to a guarantee of an on-time payment every month. If not, you may be able to have the payment charged on your credit card, but be careful with this route if you sometimes don't pay that bill on time! (Another alternative is to use online bill paying through your bank.) If, for whatever reason, you're unable or unwilling to put your bills on an automatic payment system, you can put together an accordion-style folder and organize your bills according to when during the month they need to be paid. Please understand that I think that this system is second-rate (in terms of efficiency and likelihood for success) compared with an automatic payment system.

- Develop a regular investment program. Just as Heidi did, all money avoiders should make their investing automatic. If you work for an employer, doing so is usually easy. Often, the most daunting part of the process is wading through the wad of retirement plan and investment information and brochures your benefit's department may dump upon you when you tell them that you want to sign up for their payroll deduction savings program. Not only will your money grow faster inside a tax-deferred account, but your employer may also offer free matching money. The simplest way to navigate through the morass of paperwork is to look first for the specific form you must complete to sign up for the payroll investment program. Thoroughly read that form first so that you know what you need to focus upon and get smarter about as you review the other materials. If your earnings come from self-employment income, you'll need to establish your own retirement account. Learn about the different retirement account options and choose the one that best meets your needs. The two self-employed retirement account options that enable you to sock away the greatest amounts are SEP-IRAs and Keoghs. With each of these plans, a self-employed person may contribute up to 20 percent of their business' net income up to a maximum of $49,000 for tax years 2009 and 2010. These plans may be established through the major mutual fund companies that I like such as Vanguard, Fidelity, and T. Rowe Price. And, you can generally set up these accounts so that a regular monthly amount is zapped electronically from your local bank account into your mutual fund investment account. (Be careful not to over fund your account which may happen if you overestimate your business income prior to completing your tax return.)

- Close insurance gaps. Nearly every money avoider I've met over the years has problematic gaps in their insurance coverage. Solving this problem presents some challenges because understanding various policies and the coverage of each is complicated. Add on top of that the unfortunate fact that to buy most insurance policies, you must deal with a commission-based insurance agent. Talk about a recipe for headaches and conflicts of interest! But these are not acceptable excuses for avoiding this issue because so much is at stake.

- Hire financial help, carefully. Money avoiders are clearly a group of people who could benefit from hiring a financial advisor. However, they're also among the people most likely to make a poor choice when hiring. It's difficult to evaluate or care enough to evaluate the financial expertise (and potential conflicts of interest) of a financial advisor if you're disinterested in, (or suffer anxiety about) and actively avoid money issues. Your first step, if you're inclined to hire help, is to clearly define with what it is that you desire assistance. Do you need assistance with analyzing your budget and developing a plan to pay down consumer debt? If so, most financial advisors aren't really trained for or interested in helping you with that - there's far more money to be made selling investment and insurance products to the affluent. Advisors are best suited for folks who want to quantify how much they should be saving for specific goals and determining where to invest it. However, there's no getting around it: You do have to do a lot of digging to find a competent and ethical advisor who has reasonable fees. With that information in hand, you can confidently and strategically evaluate potential service providers who can help you overcome your inertia and get you on track managing your money.